Welcome Guides for New Florida Members

To ease your transition to DFCU Financial, we've created Welcome Guides to help you navigate upcoming services and account updates.

- Personal Services Welcome Guide

- Business Services Welcome Guide

- Treasury Services Welcome Guide

- See page 9 for Quickbooks® user info

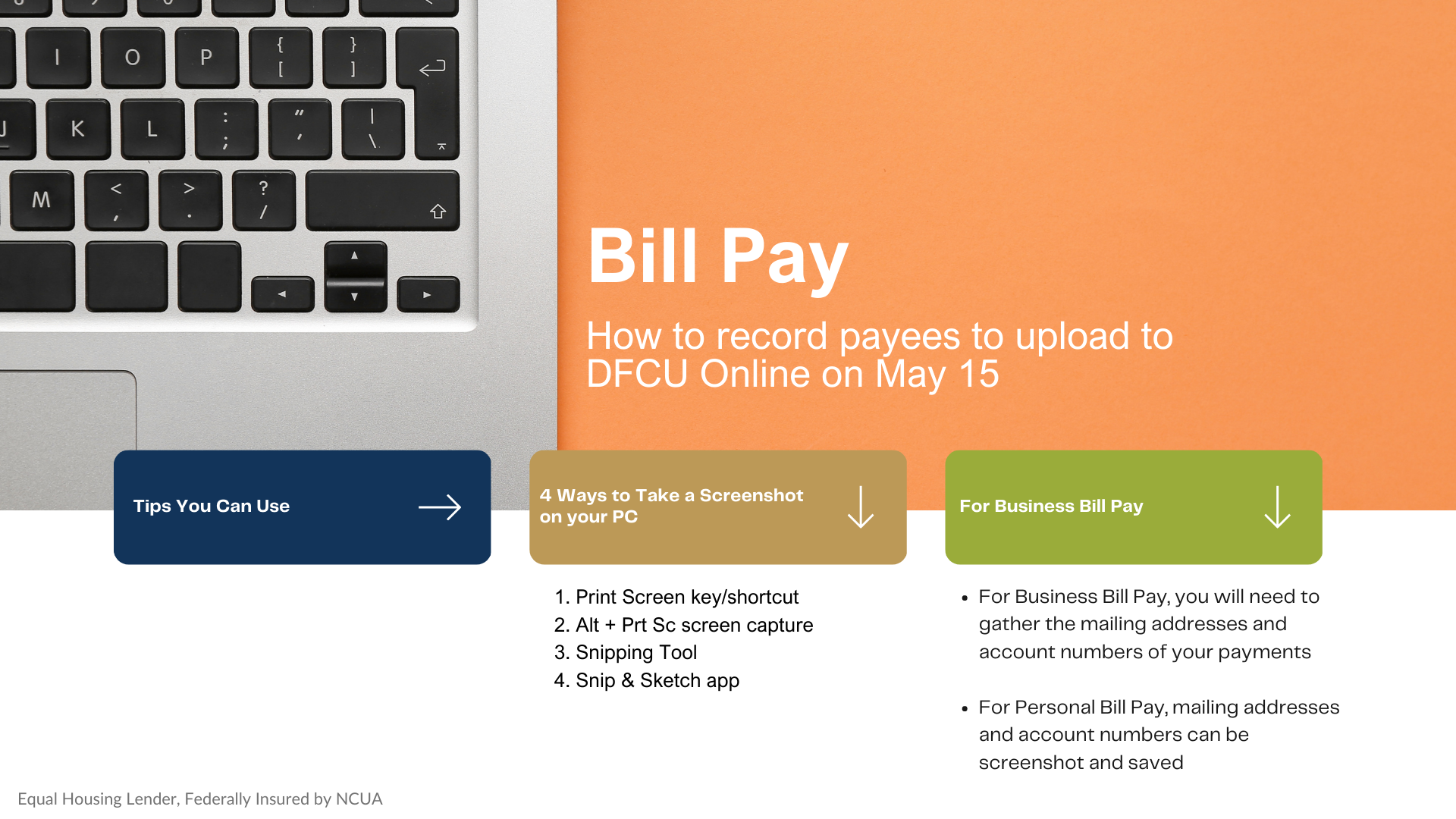

- Bill Pay | How to Record Payees

Click a Guide Below

Updated Hours of Operation

Monday to Friday

Lobby: 9:00am-5:00pm

Drive-Thru: 9:00am-5:00pm